3 Ways B2B Startups Can Solve Their Biggest Go-to-Market Data Integrity Issues

How healthy is your data integrity? According to many B2B revenue leaders, their data and methods of measuring key performance indicators could use a...

5 min read

Scott Stouffer

September 2, 2020

Scott Stouffer

September 2, 2020

Most early and growth stage B2B startups squander precious time and expensive capital thrashing through sales and marketing approaches that constantly change without any reliable data to inform their decision-making.

According to venture capitalists, at least 50 percent of sales and marketing spend by growth stage SaaS companies is nonproductive, resulting in skyrocketing customer acquisition costs (CAC), shortened capital runways, depressed growth, and ultimately lower valuations.

This article isn’t about blaming sales and marketing people, because it’s (usually) not their fault.

This is about reframing the way CEOs and revenue leadership teams manage their investments in new customer acquisition.

Here’s what we’ll cover:

Let’s first look at what SaaS companies typically invest in sales and marketing in order to acquire customers.

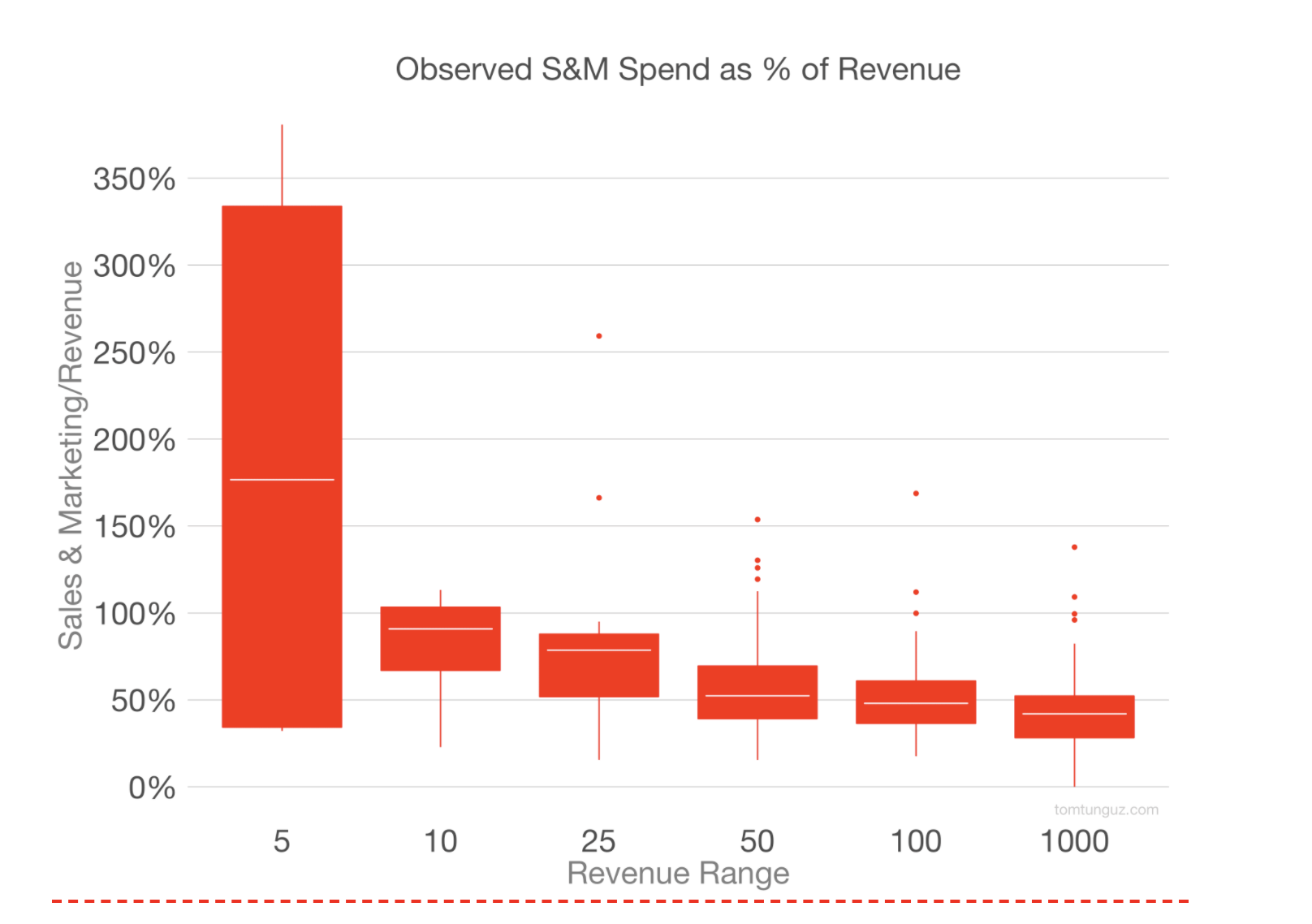

For venture capital-backed B2B companies, customer acquisition investments range anywhere between 24 and 384 percent of revenue. That really narrows it down, doesn’t it?

The truth is, the answer largely depends on company size, stage and growth rate. It also depends on who you ask!

The Edison Partners 2019 Growth Index reported that fast-growing companies in their portfolio spend on average 50 percent of their revenue on sales and marketing, whereas slower-growth companies spend on average 24 percent of their revenue on sales and marketing.

Tomasz Tunguz of Redpoint Ventures reported that the very fastest SaaS growers he’s observed spend more than 300 percent of their revenue on sales and marketing when they are in the early growth stages.

With those reference points in mind, let’s look at an example of a $10 million ARR SaaS company that is investing 50 percent of their revenue ($5 million) on new logo acquisition.

A typical B2B startup would view that $5 million sales and marketing budget as money to split between marketing people, programs and advertising and sales people. Sales would measure pipeline against their goal and separately, marketing would measure leads against their goal.

A data-FIRST company would view that $5 million as an investment portfolio, where the collective leadership team serves as the portfolio manager. Together, they would work to allocate their available cash into customer sourcing strategies that yield the most new customers in the most cost effective way.

Managing growth like an investment portfolio manager isn’t for the faint of heart.

It requires precise end-to-end process mapping and measurement of every strategy, a tedious exercise that growth stage B2B companies don’t typically prioritize as they build their go-to-market engine.

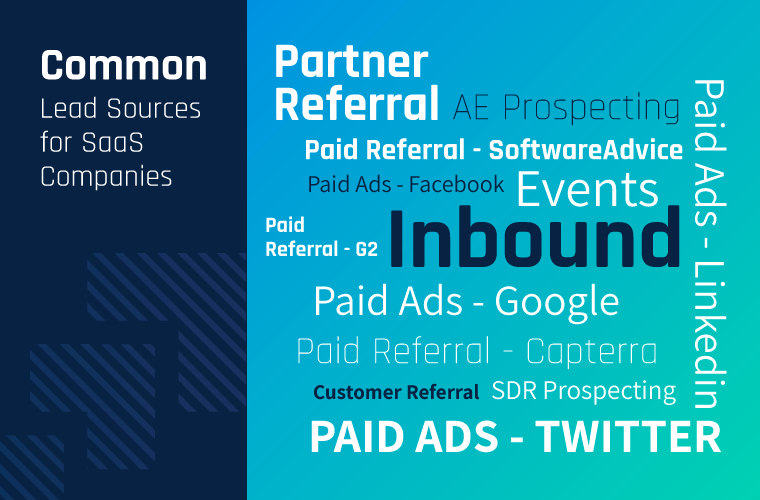

Typical B2B startups pay attention to their costs per lead and how that CPL varies across different lead generation strategies.

Unfortunately, strategy-specific measurement generally stops with the top of the funnel (leads/MQLs) and does not continue through to the middle of the funnel (meetings set and meetings held) and bottom of the funnel (opportunities and deals).

Most companies use Google Analytics, Hubspot/Marketo to track lead sources at the top of the funnel, then they lump all of their leads together and use Salesforce or a pipeline analytics tool to measure sales cycles, pipeline conversion rates and other bottom of the funnel metrics.

These reporting silos create a situation where what appears to be an awesome strategy based on top of funnel lead volume and costs per lead may in fact be an incredibly inefficient strategy when middle and bottom of funnel resources are considered.

Perhaps certain lead sources don’t convert into deals at a high rate, or maybe resources are being applied to low yielding strategies at the expense of more productive strategies.

Most companies are completely blind to the end-to-end cost effectiveness of each strategy.

They (might) know what they pay for leads in each ‘asset class’ but they don’t know what the total return for each one is. It makes it impossible to ever compare the effectiveness of each asset to each other!

Going back to the portfolio manager analogy...can you imagine a portfolio manager knowing what they paid for each asset, but the only return number they can see is the total portfolio return? No visibility into the returns for each underlying asset in their portfolio or the hidden costs or fees associated with each one, just the cost and total return.

That would never happen.

The main responsibility of an investment portfolio manager is to allocate capital into assets that will yield the highest risk-adjusted returns. That demands understanding both the cost of the asset and the relative return on an asset by asset basis.

⇒ The bottom line: For each strategy, you have to understand the top, middle, and bottom of funnel economics combined. Only then can you compare your strategies for their relative effectiveness and make good decisions on how to invest your money and put more cash behind the more productive customer sourcing strategies...

Here are a few outcomes we have observed when leadership teams start collectively operating like an investment portfolio manager.

In order to determine how to allocate your budget into high-performing customer sourcing strategies, you'll need precise measuring tools to determine the relative performance of each strategy. Both sales and marketing will need to reference one source of truth and commit to upholding data integrity so that investment decisions can be made with confidence.

The old-school enterprise philosophy that growth is simply driven by increasing sales person headcount doesn’t apply to velocity SaaS companies. Just as asset managers develop a detailed wealth management plan with their clients, CEOs and revenue leaders must make detailed top-down plans about how they’ll source leads and close deals.

When sales and marketing leaders align on a plan and are incentivized by revenue and new logo acquisition targets, everyone pulls in the same direction. If you’re still incentivizing your marketing team on lead generation metrics, STOP!

Resistance to new ideas, suggestions, and collaboration will fade away. Phony symbols of influence such as “how many people I manage” or “how large my budget is” or “this was my idea” don’t matter anymore.

This tension will never completely evaporate, but revenue leaders who are unified on a main goal of allocating spend to maximize returns will make decisions together and own the results together (good or bad).

Arguments about leads counts, revenue contribution, and MQL/SQL definitions should become a thing of the past. What matters is that your top of funnel lead generation investments produce enough quality volume to maximize bottom of funnel sales capacity.

With precise measurement of every volume, conversion, and duration metric, it’s easier and faster to spot leaky funnels or underperforming strategies so you can either fix the problem or redeploy spend into other strategies. This “factory-floor” approach reduces the wasted motions and money that skyrockets CAC for B2B startups as they scale.

While this article has been promoting end-to-end measurement of all your customer acquisition strategies, it’s worth noting that not all sales and marketing is directly measurable.

On average, growth stage SaaS companies implement approximately 3-7 direct customer acquisition strategies.

With a properly instrumented tech stack, it’s easy to measure leads and customers sourced from direct channels such as SDR prospecting or Facebook advertising.

But, how do you measure business indirectly generated from pure branding activities, from word-of-mouth referrals, from your sales leader who has a significant LinkedIn following, from your CMO’s byline quote on TechCrunch, or from your CEO’s speaking engagements?

Unfortunately, you can’t. Not all of your sales and marketing spend can be tied to results.

You can’t be 100 percent definitive about any of the indirect activities impacting new business—but there is no doubt that like a rising tide lifts all boats, strong branding can make all your demand generation strategies more successful.

How will I know if branding is impacting demand gen?

⇒ The lesson: Instrument your tech stack and put BI in place to measure everything you can. But, don’t waste time trying to measure the impossible.

How healthy is your data integrity? According to many B2B revenue leaders, their data and methods of measuring key performance indicators could use a...

Spewing, hand-waving and back-pedaling. I can’t even count how many times across so many companies as CEO or Board member that I’ve asked questions...

How the quest for simplification drove ignorance (not dissimilar to politics) Lifetime Value / Customer Acquisition Costs (LTV/CAC) has long been a...